BeCompliant Digital Onboarding

Procedure for a company to register a digital client in its system by remotely validating the person’s identity.

STEPS TO OBTAIN A DIGITAL IDENTITY

A scan of the identity document is done to validate the authenticity of the document based on OCR and AI (Artificial Intelligence) technology. Extract the photo printed on the document and personal data, with these data it would automatically register in the system in case the document and the user are authentic.

Take a selfie making proof of life. Helps prevent fraud when an impostor tries to use photos of other people.

The user takes a selfie and goes through the liveness verification check to verify their identity using facial recognition “FaceMatch”. BeCompliant matching the selfie to the picture captured from the ID document. If the verification is successful, the user is allowed to proceed to onboarding.

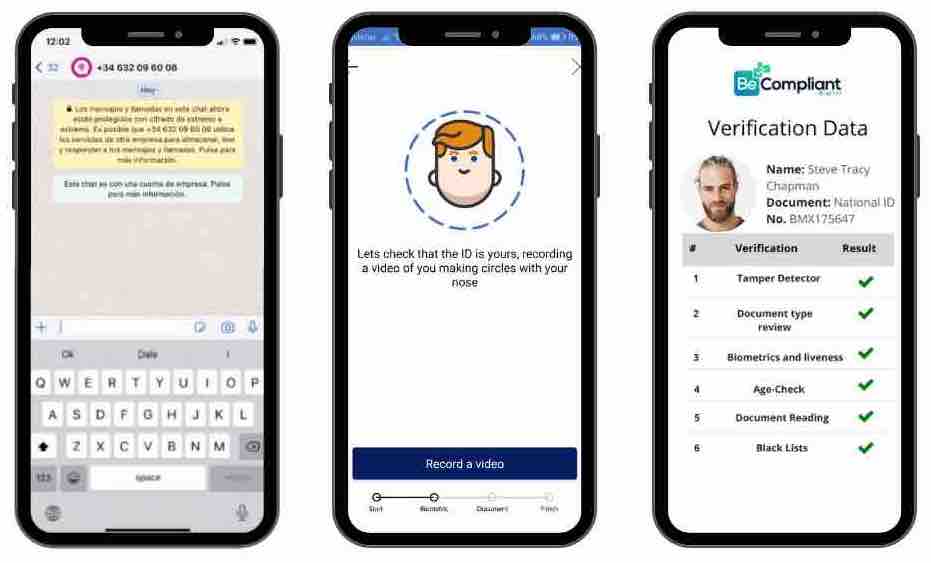

Id Chatbot Identity Checker

Solution oriented to companies that offer their users a fast response service, without delays and with full confidence in the processes of remote user identification.

You can send automatic messages by connecting your web information system (portals) or Apps to our official API for WhatsApp Business.

Our platform is intuitive and easy to use while complying with all HABEAS data, GDPR and liveness detection (life proof) regulations.

HOW CAN A CHATBOT VALIDATE

THE USER IDENTITY

The user initiates a conversation with the chatbot.

The user requires to carry out a high risk transaction (for example transfer 50,000 euros) and the process requires remote identity validation.

In case the identity validation is successful, the chatbot processes the money transfer transaction.

APPLE

Our technology connect business and customers through WhatsApp, Facebook Messenger and Apple business, also doing authentication processes with digital identity and proof of life.